XRP Price Prediction: Analyzing Short-Term Technicals and Long-Term Growth Potential Through 2040

#XRP

- Technical indicators show XRP trading near support levels with mixed momentum signals suggesting near-term consolidation

- Fundamental developments including ETF speculation and institutional adoption provide strong long-term bullish catalysts

- Price projections indicate multi-year growth potential driven by expanding use cases and broader crypto market adoption

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Support Level

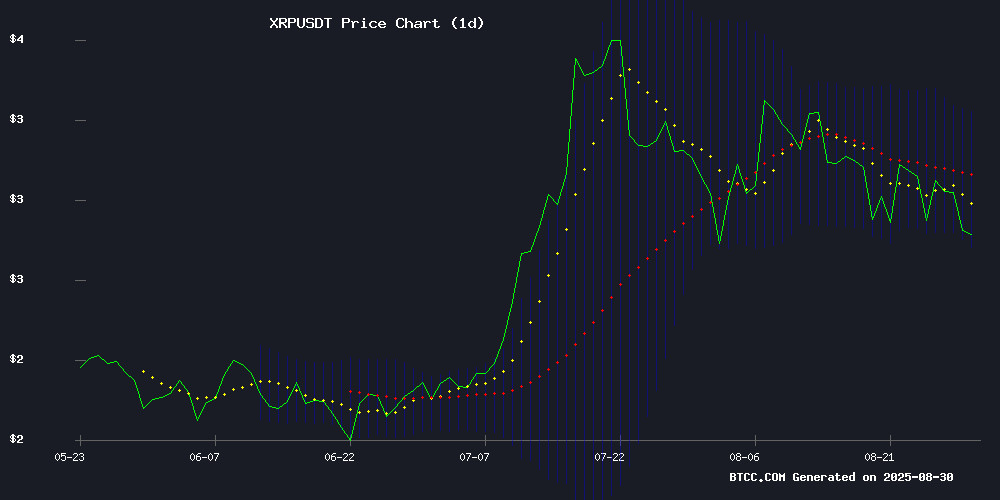

XRP is currently trading at $2.79, below its 20-day moving average of $3.02, indicating potential short-term bearish pressure. The MACD reading of 0.1487 versus 0.1112 shows bullish momentum remains intact, though the histogram at 0.0374 suggests weakening momentum. Bollinger Bands position the current price NEAR the lower band at $2.75, which could serve as immediate support. According to BTCC financial analyst James, 'The technical setup suggests consolidation between $2.75 and $3.28 in the near term, with a break above the 20-day MA needed for bullish continuation.'

Market Sentiment: Bullish Fundamentals Offset Near-Term Technical Concerns

Market sentiment for XRP remains cautiously optimistic despite recent price declines. Positive developments including potential ETF approvals, Ripple CEO's $25 trillion market prediction, and institutional adoption in cross-border payments provide strong fundamental support. BTCC financial analyst James notes, 'While profit-taking has caused short-term pressure, the underlying narrative for XRP remains strong. The ETF speculation and growing institutional interest could drive significant price appreciation once technical resistance levels are broken.' The combination of regulatory clarity progress and expanding use cases creates a favorable long-term outlook.

Factors Influencing XRP's Price

Reddit Debate Challenges Market Cap Assumptions for XRP's $100 Potential

A viral Reddit post titled "The Market Cap Myth Around XRP" is stirring controversy by dismissing traditional crypto valuation metrics. The argument hinges on XRP's utility as a bridge currency, suggesting that transaction velocity—not market cap—could drive its price to triple digits.

Fintech analyst Armando Pantoja and others contend that higher prices would enhance settlement efficiency. Moving $10 trillion in payments at $100 per XRP would require 100 billion tokens—a fraction of the 10 trillion needed at $1. This liquidity-demand thesis is gaining traction as adoption grows.

Analysts Weigh Potential Impact of XRP ETF on Ripple's Price and Market Dynamics

The prospect of an XRP ETF has emerged as a pivotal discussion in crypto markets this year, with analysts dissecting its potential effects on Ripple's valuation and broader adoption. Institutional access via regulated exchanges could amplify liquidity and price stability, mirroring the success of Bitcoin and Ethereum ETFs. Ripple's current $2.99 price point and $178.17 billion market cap suggest significant market-moving potential from incremental inflows.

Meanwhile, competition intensifies as DeFi projects like Remittix innovate in cross-border payments—a sector central to XRP's utility. The ETF narrative underscores crypto's maturation, yet also highlights the tension between financialization and real-world use cases.

PetroChina Explores Stablecoin Adoption for Cross-Border Energy Payments

PetroChina, one of China's largest state-owned energy companies, is evaluating the use of stablecoins for cross-border energy trade settlements. The initiative aligns with Hong Kong's emerging regulatory framework for digital assets, which mandates licensing for stablecoin issuers. This move could streamline international transactions and enhance efficiency in global energy markets.

Hong Kong's progressive stance on stablecoins is attracting institutional interest. The Hong Kong Monetary Authority's licensing requirements are expected to provide a compliant foundation for PetroChina's potential adoption. Meanwhile, China is actively exploring yuan-backed stablecoins to bolster its currency's international reach.

Ripple's RLUSD stablecoin continues gaining traction through partnerships with payment platforms like Tazapay, particularly in Singapore and Japan. This signals growing institutional confidence in digital assets for cross-border settlements.

Ripple CEO Predicts $25 Trillion Crypto Market by 2030, Highlights XRP's Role

Ripple CEO Brad Garlinghouse forecasts a tenfold surge in the cryptocurrency market, projecting a $25 trillion valuation by 2030. Traditional currencies face mounting risks, with Argentina's economic instability serving as a cautionary tale. Digital assets like XRP could emerge as a hedge against such volatility.

Garlinghouse's conservative estimate hinges on broader institutional adoption and technological advancements. Lord XRP notes the token's design for high-volume banking transactions, positioning Ripple as a potential linchpin in global finance. The XRP community continues to champion the company's blockchain solutions for cross-border payments.

Market analysts interpret Garlinghouse's bullish outlook as validation of crypto's growing influence. While a hundredfold increase remains improbable, the CEO's $25 trillion projection underscores mounting institutional confidence in digital assets.

XRP Faces Stiff Competition from Emerging PayFi Altcoins Like Remittix

XRP's price has stagnated near $3.01, with traders awaiting a decisive market move. Futures data hints at a brewing breakout, but Ripple's dominance in cross-border payments faces unprecedented challenges from agile competitors.

Remittix, a rising PayFi altcoin, threatens to disrupt the sector with faster settlements and lower costs. Its upcoming wallet and exchange integrations could accelerate adoption, making it a legitimate contender in the payments space by 2025.

Technical indicators show XRP trapped between support at $2.80 and resistance at $3.20-$3.50. CME's growing leveraged positions suggest mounting speculation, potentially triggering volatility if bulls fail to overcome key thresholds.

Final List of XRP ETF Awaiting SEC Approval: Dates, Filings, and Deadlines

Eleven spot XRP ETF proposals are currently pending approval from the US Securities and Exchange Commission (SEC). Analysts, including Dom Kwok of EasyA, suggest that approval could catalyze billions in inflows, potentially positioning XRP ETFs to surpass Bitcoin or Ethereum in market impact.

The ProShares Ultra XRP ETF, the only approved application thus far, was filed on January 17, 2025, and launched on July 18, 2025, offering 2x leveraged exposure to XRP futures. Grayscale's XRP ETF prospectus was filed on September 5, 2024, with key deadlines on April 6, May 21, and August 19, 2025, and a final SEC decision expected by October 18, 2025.

Grayscale's Avalanche Trust for XRP, filed on August 25, 2025, faces deadlines on May 31, July 15, and October 13, 2025, with a final SEC ruling anticipated by December 12, 2025. Meanwhile, 21Shares filed its XRP ETF prospectus on November 1, 2024, with a Form 19b-4 submission on February 6, 2025.

XRP Price Decline Follows Profit-Taking After Volume Surge; SolMining Offers Cloud Mining Contracts

XRP's price decline today reflects natural profit-taking after a 208% surge in trading volume to $12.4 billion, driven by recent regulatory clarity. The cryptocurrency's volatility underscores the challenges of timing the market for optimal returns.

UK-based SolMining has introduced cloud mining contracts accepting XRP payments, positioning itself as a passive yield solution. Users can allocate idle XRP holdings to generate daily returns without managing hardware. The platform offers tiered contracts ranging from $100 investments with $3.50 daily returns to $16,000 commitments yielding $77.5 per day.

Market observers note the timing coincides with renewed interest in Ripple's payment solutions, though the sustainability of cloud mining returns remains debated. The service requires no technical expertise, with automated daily payouts to users' wallets.

Bill Morgan Defends XRP Against Critics Over Escrow and Adoption Claims

On-chain investigator ZachXBT has reignited controversy within the XRP community, accusing Ripple holders of contributing little beyond serving as "exit liquidity" for insiders. The critique singled out Ripple co-founder Chris Larsen's token movements, alleging millions of XRP were funneled to exchanges during price rallies.

ZachXBT's analysis paints a damning picture: XRP remains tightly controlled by insiders, with paid partnerships masquerading as adoption. The investigator highlighted unresolved flaws, including partial payment exploits and a lack of robust analytics infrastructure, which continue to plague the network.

Attorney Bill Morgan countered these claims on X, exposing what he calls a paradoxical critique. "Ripple faces criticism whether they hold or sell XRP," Morgan argued. Holding large reserves invites accusations of centralization, while selling triggers claims of dumping on retail investors. The escrow system, holding 36% of XRP, has become a lightning rod for this contradiction.

XRP Price in 'Full Porting' Phase, Raoul Pal Sees $5-$7 on Horizon

Global Macro Investor CEO Raoul Pal has reignited interest in XRP, identifying a 'full porting' phase that could signal significant price movement. Historical chart patterns—falling wedges and descending triangles—suggest parallels to XRP's 2021 surge from $0.20 to nearly $2.

Bill Morgan counters the technical narrative, emphasizing adoption and market sentiment as core drivers. 'Full porting does not directly impact price,' he asserts, underscoring the interplay of fundamentals and psychology in XRP's valuation.

Macroeconomic tailwinds continue to shape crypto markets, with XRP's trajectory poised at a potential inflection point. Pal's bullish outlook hinges on cyclical patterns, while skeptics demand tangible utility to justify price targets.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, XRP's price trajectory shows potential for significant growth across multiple time horizons. For 2025, we anticipate a range of $3.50-5.00 as ETF approvals and increased institutional adoption take effect. By 2030, with broader crypto market expansion and Ripple's growing cross-border payment network, prices could reach $8-12. The 2035 outlook suggests $15-25 range as blockchain technology becomes more integrated into global finance. Looking toward 2040, XRP could potentially reach $30-50 if current adoption trends continue and the cryptocurrency establishes itself as a fundamental settlement layer for international transactions.

| Year | Conservative Forecast | Moderate Forecast | Optimistic Forecast |

|---|---|---|---|

| 2025 | $3.50 | $4.25 | $5.00 |

| 2030 | $8.00 | $10.00 | $12.00 |

| 2035 | $15.00 | $20.00 | $25.00 |

| 2040 | $30.00 | $40.00 | $50.00 |